Rochester, NY

Who We Are

Founded in 2006 as Titan Insurance & Employee Benefits Agency, LLC, our group established a strong reputation as a trusted, independent employee benefits firm headquartered in Rochester, NY.

With a primary focus on businesses throughout the Upstate and Greater New York regions, Titan joined U.S. Employee Benefits Services Group (USEBSG) in 2012, providing new access to a national network of resources for public and private employers. This partnership led to a major expansion into Long Island and Albany, New York and into Pennsylvania.

As a full-service employee benefits firm, we proudly deliver efficiencies, cost savings, and strategic thinking to employers and provide integrated solutions to one of the most expensive and critical aspects of your organization: your employees. Our commitment to remaining at the forefront of all health care and employee benefits trends is bolstered by ongoing communication and professional development that enriches this organization.

Meet our experienced and knowledgeable team.

Strategic partnerships are driven by the commitment to exceed expectation and offer value that is innovative and ahead of the curve. We are proud members and supporters of the following local, regional and national organizations:

Who We Serve

Businesses/Organizations

Whether you are a small business, large employer, or somewhere between the two, our benefits team can help identify the right criteria to provide the best plan options for both you and your employees.

Our consultative approach to developing strategy is focused on creating solutions. We understand the importance of a qualified and motivated workforce. We also know that benefits programs provided to employees are one of the most compelling drivers of staff retention. Following your unique objectives as a guide, we can help design the benefits solution that yields the best results for your organization.

Public Employers

For most school districts, health insurance is the second largest annual budget item after payroll and personnel costs — a cost that continues to rise each budget cycle. Both health care reform and changing economic conditions have transformed the world of employee benefits. In direct response to these factors, we utilize strategies that mitigate costs, creating efficiencies and savings through technology, product design, and a list of full-service features.

Critical responsibilities accompany these offerings, such as the need to balance costs with the value of benefits, adhere to compliance measures, track data and monitor eligibility — tasks that have become increasingly more difficult for many. As your partner, we act as a trusted advisor for all facets of a district’s health and welfare plan. We manage the complete employee benefits experience to create an environment of success in an innovative and adaptable way.

Individuals

Have you lost group coverage? Are you a sole proprietor? Are you retiring early and in need of a health plan to fill the gap prior to Medicare? We can help.

As licensed brokers on and off the exchange, we are able to recommend plans and solutions for individuals looking for affordable benefits and excellent coverage. We are committed to being industry experts and helping our clients find health plans that fit their specific, individual needs. Whether you are considering a high-deductible health plan or a more traditional co-pay plan, our recommendations are based solely on your goals and best interests. As consumer-driven health care continues to create a greater variety of options, we are committed to making all options available to you.

Working with an experienced consultant means you can have the best options available on the market customized specifically for you.

Services

We serve employers of various types and sizes, as well as individuals, with an all-encompassing approach to employee benefits, providing a one-stop resource for our clients in the New York and Pennsylvania areas. Our ability to deliver excellence through employee advocacy, compliance support, analytics, and HR technology offers seamless administration to anyone looking for a reliable, competent business partner in the employee benefits arena. We rigorously pursue new ideas, work with best-in-class partners, and consistently challenge the status quo in order to provide our clients with the industry’s best options through a singular resource: your relationship with us.

Utilizing a consultative and analytical approach to your employee benefits plans begins with our team developing a deep understanding of your goals. Plan design, contribution strategies, and the impact of health care reform all shape the needs of your employee benefits plans. Our consultants guide you through this compliance-heavy landscape and recommend options that suit your individual or organizational needs and objectives, crafting strategies that promote wellness, reduce risk, and deliver high-quality service at a low cost.

Our firm is a member of the ProSential Group — one of the largest broker groups in the country. Through ProSential’s exclusive online private exchange solution, we are able to offer competitive benefits options to our clients in an all-inclusive, user-friendly platform. Our ProSential partnership provides us with a national vehicle for best practice solutions that are supplemented by industry-leading technology, allowing us to share a bounty of resources with our clients, including payroll, workforce management, administration, legal guidance, access to our private exchange and outsourcing HR needs.

Preparation & Consultation Services, including:

- ACA Compliance Support & Guidance Audits

- Comprehensive Health Care Reform Consulting

- Efficiency through Technology & Benefit Administration

- Integrated Payroll & Workforce Planning

- Ongoing Enrollment & Marketing

- Full Carrier Management

- Benefit & Contribution Strategy

- Employee Engagement & Education

- Full-Service Team, from Group Underwriter to HR Support

Services for Core and Voluntary Benefits, including:

- Section 125 Administration

- Flexible Spending Accounts (FSAs)

- Health Reimbursement Accounts (HRAs) or Health Savings Accounts (HSAs)

- Dental Plans

- Vision Plans

- Telemedicine

- Life Accidental Death & Dismemberment (AD&D)

- Voluntary Life

- Short & Long Term Disability

- COBRA/HIPAA Administration

- Critical Illness

- Various Worksite Products (e.g. Cyber Theft, Pet Insurance)

Consulting

Our consultants are ready to work with you to build a detailed understanding of your unique goals. Once goals are defined and can be targeted, we develop and strategize a plan that delivers for both employer and employee.

Our Consulting Services Deliver:

- Relationships founded on a consultative and analytical approach that considers your company’s goals, business model and niche, industry-specific objectives

- Current and long-term solutions that support your objectives and are advocated for in all service provider relationships

- Funding alternatives through contribution study and analysis

- Solution-based thinking that utilizes a team of experienced professionals

- In-house marketing department that expertly markets to multiple carriers

- Plan recommendations of benefits plans that meet your short-term and long-term goals

- Enrollment/Education to ensure employee understanding and satisfaction

- Employee services that take the management burden off you

- Proactive plan review to ensure the plan’s continued effectiveness, efficiency, and compliance

Compliance

The Expertise You Need to Succeed

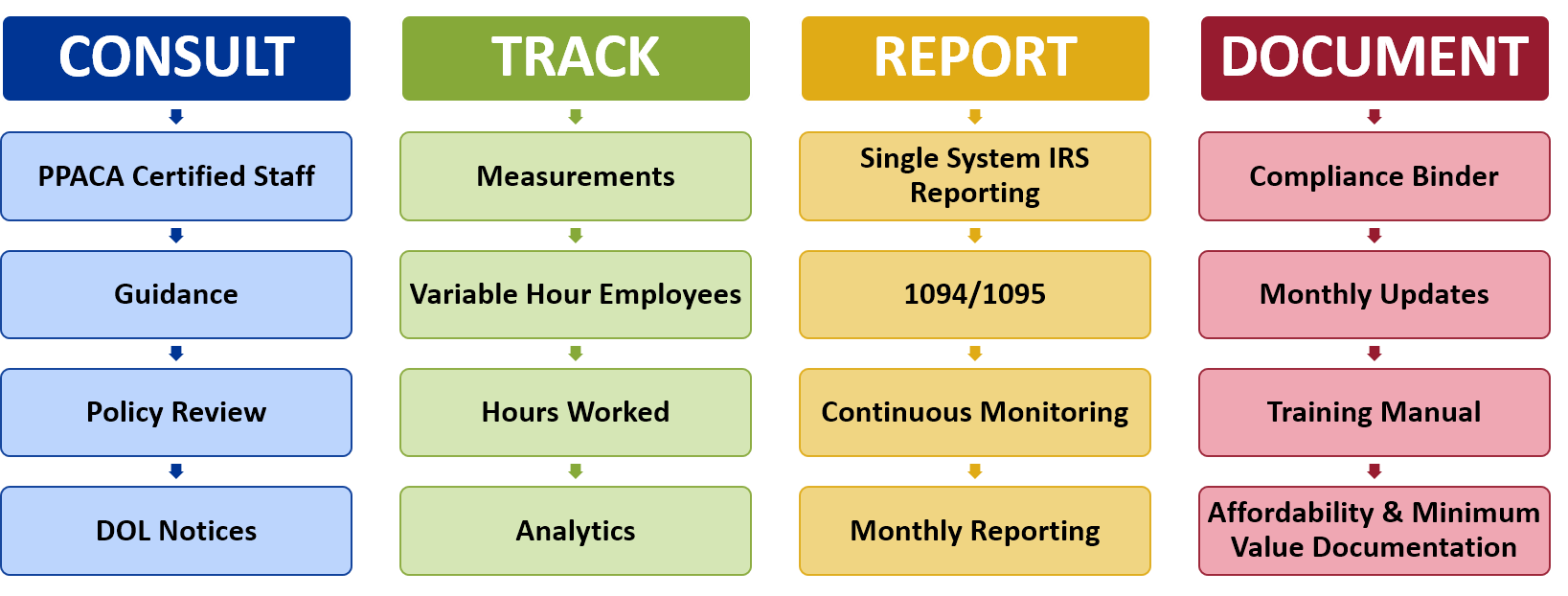

Ensuring Benefits Plan Compliance: Ongoing compliance support is critical, especially regarding health care reform. Industry regulations force organizations to meet regulatory requirements of the Internal Revenue Service, Department of Labor, and the Federal Government. Our stringent compliance oversight offers protection from incurring liabilities you may otherwise encounter.

Our consultants are ready to review your current plan, identify potential compliance concerns, and develop an employee benefits plan that ensures your compliance with federal and state regulations. Helping our clients build awareness and knowledge of all aspects of the compliance process allows them to tend to their business needs with confidence.

Affordable Care Act Compliance: We host ACA educational seminars and planning meetings to maintain open and transparent communication with all stakeholders. Our clients are confident of their compliance with all federal mandates because of the vital partnerships they forge with their consultant team. Our compliance team determines adherence to applicable mandates, then recommends tools to streamline reporting to eliminate penalties or fines.

Our ACA Compliance Services Provide:

- Employer shared responsibility (pay or play) and the development of your measurement periods

- Managing your workforce hours within the parameters of the new requirements

- Reporting requirements to the government and your employees (1094B/C & 1095B/C)

- Financial impacts of current and future legislation

- Ongoing employee education and engagement

Analytics

Protecting Your Benefits Portfolio

Our team will review plan designs and rates, utilization trends, and cost/benefit scenarios to protect and advocate for your organization’s benefits portfolio in all carrier relationships. We aggressively market all lines of ancillary coverage to assist in developing an employee benefits package that best matches your strategic goals.

Benefits & Contribution Strategy

Our expertise in analyzing trends and utilization rates helps us ensure that the level of benefits provided conforms to your budgetary expectations. Our actuarial and underwriting skills are vital assets used to analyze claims data, which helps us identify and recommend cost-saving solutions based on real metrics. An ongoing budget process, including quarterly and annual reviews, provides an opportunity to project renewal rates and offer possible resolutions based on analytics. The process allows for cost-saving measures to be more easily identified and strategically implemented.

Full Carrier Management

Ongoing claims monitoring throughout the year provides insight into plan performance and renewal increases. Once received, we compare incurred claims to internal reporting for accuracy, thoroughly reviewing methodology and all actuarial factors, including trends. This provides a foundation upon which we base and advocate our recommendations. Our in-house expertise in rate development, combined with an analytical approach, provides stability and allows you to prepare for recommended changes.

Funding Options

We can help you explore various funding arrangements for health insurance, including prospective experience rated, contingency premium, minimum premium with cash cap, and self-funding. A complete analysis of these rating methodologies will provide you with the most advantageous options that speak to your needs.

Wellness Advocacy

Increase productivity and reduce health care costs with a proactive approach to wellness.

Our efforts to promote and educate companies about wellness incentives is just one way we exercise our commitment to the overall health and well-being of our clients and their employees. A proactive approach to employees’ wellness contributes to a boost in morale, increased productivity and reduction of health care costs.

We will help you engage your employees in ongoing wellness initiatives, providing educational guidance, reading materials, and supplementary information that ensures your employees have the knowledge base to develop the skills needed to enact positive, health-conscious habits. Contact us today to learn how you can design a successful wellness plan for your organization.

Technology Solutions

We offer a host of solutions for the ever-increasing demand for integrated systems that blend payroll, human resource and workforce planning processes. The integration of automated systems can create savings and streamline administrative procedures, creating data-driven results that can lead to financially sound decision making. This level of reporting produces documentation that can safeguard against penalty scenarios and serve as a proactive best practice model.

Through our partners and affiliates, we can recommend the product that will best serve your business or organization. Our technology team is ready to walk you through each step of the implementation process, educating and advising along the way. You can rest assured that our selected partners and vendors are up to the standards that we demand in order to properly serve our clients’ needs.

Our suite of products will move your organization forward.

Team

Eric was named Managing Partner of the Rochester, NY, U.S. Employee Benefits Services Group office in August 2022 and is accountable for overseeing the New York State market in its entirety. He brings his experience in employee benefits, medical insurance and employee engagement to this leadership position.

Most recently, he had served as Managing Director for the firm, providing strategic direction and oversight in the areas of client consulting, account growth, integration of service offerings, and new business development. During his ten years in this role, Eric had direct responsibility for market growth, integration with other Partner firms and building a best-in-class team that could service the most complex of clients.

Prior to joining USEBSG-NY, Eric was the Director of Sales & Retention with Excellus BCBS and also held the position of Manager, Special National Accounts.

Mr. Gilbert graduated from St. John Fisher College with a Bachelor of Science in Business with a Concentration in Finance, and holds a New York State Life, Accident and Health insurance license. He is a Board Member of the Small Business Council of Rochester, Golisano Autism Center and Monroe Golf Club. Eric also oversees the long-standing relationship with NYBEST, which proudly supports over 200 New York School Districts.

Ed incorporates his diversified skills into a best practice model at USEBSG, bringing a data-driven perspective to health plan management. His experience extends to health care reform consulting and, through an analytical approach, he advises clients on workforce planning and management. His extensive expertise with the Affordable Care Act (ACA) aids his ability to help clients ensure compliance. Ed provides analytics respective to the ACA including Pay-or-Play calculations, affordable cost review, and assists with establishing stability and measurement periods. He also helps deliver strategic analysis of benefit designs, carriers, and employer contributions.

The actuarial experience he has developed enables him to identify trends in clients’ data and work with them to develop solutions that best suit their unique needs. He negotiates rates and benefit arrangements with carriers based on an actuarial approach with the goal of ultimately providing the best cost-benefit scenario for the firm’s clients.

Ed earned his MBA from Rochester Institute of Technology with a concentration in Environmentally Sustainable Management, and his BS from Nazareth College, where he majored in Accounting with minors in Marketing and Inter-national Business.

Bryan Coon joined the Rochester, NY, U.S. Employee Benefits Services Group office in November 2022 as the Senior Director of Sales and Business Development. He is accountable for the strategy and overall growth of the New York State market. Bryan brings extensive growth and leadership experience within the employee benefits industry to this leadership position.

Most recently, Bryan was part of the Executive Leadership Team at Benefit Resource, LLC (BRI) where he served as the Vice President of Client Services. He was responsible for providing strategic direction and leadership of the Client Service organization including operations, service delivery, and relationship management.

Prior to that, Bryan served as the Director of Account Management for BRI where he was accountable for client retention and new business expansion. He also gained vast experience in group insurance and payroll during his time at Paychex where he held increasingly senior leadership positions culminating as a District Sales Manager.

Bryan graduated from Nazareth College with a Bachelor of Science in Business Administration. He holds a New York State Life, Accident and Health Insurance License and is also Certified in Flexible Compensation.

Chris brings a significant resume of banking experience as well as sales expertise to his position both as an associate and banking officer.

He will be responsible for an expanding client base that extends downstate and throughout a diverse client base, including public and private sectors. Chris will consult and foster business relationships that expand business opportunities across the state from public to corporate entities.

Chris is licensed Life, Accident and Health and graduated from Elmira College with a Bachelor of Science degree with a concentration in Business Management. He is active with the Rochester Young Professionals business organization.

Quentin Marsh joined U.S. Employee Benefits Services Group (USEBSG) in Rochester, NY, in May 2024. He brings a wealth of experience and a dynamic approach to his role as Sales Director. With a keen focus on expanding the client base and market share in the greater Rochester area, Quentin is dedicated to delivering tailored solutions to meet the diverse needs of businesses in the private sector.

Prior to joining USEBSG, Quentin honed his expertise as a licensed insurance producer at Elmwood Agency and previously served as an insurance agent at Liberty Mutual. His hands-on experience in the insurance industry has equipped him with invaluable insights and a deep understanding of client needs.

Quentin holds a Bachelor of Music Education from the University of Dayton and is licensed in New York State for Life, Accident, and Health, as well as Property and Casualty insurance. With a passion for building meaningful relationships and a commitment to excellence, Quentin is poised to make a significant impact in helping businesses thrive through comprehensive employee benefits solutions.

Sharon’s role encompasses the vast array of skills necessary to navigate Health Care Reform, compliance, and technology needs for our clients in all markets. She oversees all compliance-related activities, including changes due to Health Care Reform, Department of Labor notices to employees, CMS notices to employees, and all required Health and Welfare SPD and Wrap Plan Documents. Sharon manages the client experience with our on-line tools – Client Resource Center, Compliance Dashboard, and InRoll, in addition to assisting clients with adherence to mandates and guidelines in accordance with regulations required by law.

She guides clients through the implementation of technological applications and designs solutions to streamline processes. She regularly shares her exper-tise in health care reform compliance efforts with audiences across the state, ensuring best practice implementation for the firm’s expanding client base.

Sharon graduated with a Bachelor’s of Arts and Sciences in Liberal Arts and Communication from SUNY Oswego. She is NYS licensed in Life, Accident and Health.

Tony’s responsibilities range from all aspects of compliance work, such as Wrap Document preparation, Summary Material Modification distribution, and 5500 Filings, to the implementation and maintenance of various technology and benefit administration systems, including bSwift, Worxtime and InRoll. He has extensive experience and knowledge around the Affordable Care Act, and ensures client groups of all sizes meet mandated requirements.

He has a comprehensive background in the finance industry, and related customer and client service industries with an emphasis on achieving and maintaining complete client satisfaction.

Kim has extensive responsibilities as an Account Manager. She has a high level of experience within the employee benefits industry encompassing group and voluntary plans, as well as self-funded and fully insured medical, dental and vision plans.

Her dedicated client account management and advocacy efforts strive to improve coverage knowledge, providing assistance and expertise to facilitate client satisfaction.

Continuous educational efforts to assist client groups in benefit plan management results in increased understanding and improved utilization of the their benefit plans. Kim’s strong benefit administration management and knowledge drives results in process improvements.

Kim graduated from SUNY Brockport with a Bachelor’s of Science degree in Communications with a concentration in Interpersonal and Organizational Communications. She is licensed Life, Accident and Health

Kristen’s responsibilities as an Account Director extend to all aspects of account management from Open Enrollment to group benefit plan renewal. She manages client proposals, presentations and all marketing and enrollment processes.

Kristen has a diverse and substantial background in benefits and administration platforms, as well as HR policies and procedures resulting in superior account management for her client groups. Her vast benefit knowledge extends from compliance and regulatory requirements to implementation of plan designs that create options for diversified offerings. Her expertise in key areas is a solid foundation to deliver excellent service to all of her client groups.

Kristen graduated from St. John Fisher College with a Bachelor’s of Science in Business Management and a Concentration in Human Resources. She is licensed Life, Accident and Health.

Katy is an Account Manager with concentrations in both the public sector and corporate account market segments. She has amassed a depth of knowledge from her experience with insurance agencies and major market carriers. She recommends, presents and services optimum benefit options through her marketing analysis and expertise for her account groups.

Katy has earned her GBDS designation distinguishing her ability to engage school districts about the entire group benefits product portfolio, specifically the importance of disability income insurance.

As an important component to financial security, she is able to demonstrate to clients the critical importance of disability insurance for their employees and themselves.

She graduated from the University of Buffalo with a Bachelor of Science degree in Business Administration and a concentration in Human Resource Management.

Michael has significant experience within the employee benefits arena and specializes in large group accounts. His background enables him to provide solutions grounded in critical product knowledge and experience to ensure seamless customer service. Strong relationship management on the carrier side facilitates his capacity to deliver an exceptional customer experience.

This foundation enables Michael to implement the processes and procedures necessary to align with the quality of service the firm delivers.

Michael is licensed Life, Accident and Health and is a graduate of Monroe Community College.

Sandra enhances client experiences by consistently implementing process improvements in a dynamic industry to exceed client expectations, utilizing technology and constantly evolving best practice solutions. In addition to client management and the service, enrollment and renewal of accounts, her expertise in the small business department provides clients with immediate and knowledgeable support.

Sandra’s background includes experience on the carrier side and in computer technology. She also has extensive experience in business administration and processes. Sandra is licensed NYS Life, Accident & Health.

Tara’s extensive service background encompasses every aspect necessary to support clients, and support the team’s work. From overseeing enrollments, and renewal of benefit plans to assisting with claims issues, she facilitates carrier follow-up and issue resolution as needed. She is attentive to each client’s individual needs to deliver an exceptional service experience.

Tara’s background in both healthcare and finance provides a wide perspective of experience from which to complement her skill set. Tara graduated from Roberts Wesleyan College with a Bachelor of Science Degree in Health Administration and is NYS Licensed Life, Accident, and Health.

Majed joined USEBSG as a Client Service Specialist in 2022. In his role, he will support Mindex in day-to-day service areas, such as enrollment changes, benefits administrative system utilization, carrier interactions and advocacy, member services, and plan renewals. He has extensive experience in customer service and the banking industry, where he has worked both locally and in Germany. Majed comes to us from Damascus, Syria and holds degrees in Economics from universities in both Syria and Germany. In his spare time, he enjoys photography, soccer, and spending time with his wife.

Lasana joined U.S. Employee Benefits Services Group in 2021 as an Enrollment Specialist, coming to us with a strong background in customer service and data processing. In his role of Enrollment Specialist, Lasana supports our benefits consulting clients by navigating through carrier systems and benefit administration platforms to manage all enrollment activities. He also supports our compliance efforts through data management and processing.

Prior to joining USEBSG, Lasana spent nine years at an insurance carrier in member services, engaging with members on a daily basis to solve complex issues related to their plans.

Contact

Rochester, NY

One South Clinton Ave., Suite 1030

Rochester, NY 14604

Phone: (585) 270-5761

Fax: (585) 546-8315

Long Island, NY

2410 North Ocean Ave., Suite 500

Farmingville, NY 11738

Phone: (855) 562-7821 x112

Fax: (631) 467-3263

Capital Region

5 Southside Dr., Suite 11-180

Clifton Park, NY 12065

Phone: (855) 562-7821 x125

Fax: (585) 546-8315